Executive Summary

REITs (i.e., FIBRAs in Mexico) have existed in Mexico since 2011 and collectively represent 4% of the total market cap of the Mexican stock exchange.

These FIBRAs hold over 1,900 properties across over 27 million square meters (i.e., 290 million square feet) of gross leasable area. FIBRA Uno was the first FIBRA in Mexico, and is the most dominate commanding nearly a 25% market share.

At first glance, FIBRAs appear to be an attractive option for American investors to gain exposure to Mexico’s real estate sector. In spite of these perceived advantages, they have had a difficult time attracting capital from America.

Some of those potential deterrents to receiving American investments are considered in the report and they include: 1) agency issues in management structures, 2) taxation, and 3) currency concerns.

In the case of FIBRAs, certain American investors may appreciate the niche themes of: 1) satisfying asset allocation mandates, 2) hedging currency risk, and 3) as part of a market entry strategy.

Introduction

REITs (i.e., FIBRAs in Mexico) have existed in Mexico since 2011 and collectively represent 4% of the total market cap of the Mexican stock exchange. These FIBRAs hold over 1,900 properties across over 27 million square meters (i.e., 290 million square feet) of gross leasable area. FIBRA Uno was the first FIBRA in Mexico, and is the most dominate commanding nearly a 25% market share.

At first glance, FIBRAs appear to be an attractive option for American investors to gain exposure to Mexico’s real estate sector. They are regulated, tax advantaged, listed on the Mexican stock exchange, own most of the prime assets in the country, and offer a significant degree of liquidity. In spite of these perceived advantages, they have had a difficult time attracting capital from America. The below analysis attempts to square this contradiction by looking at historic returns, investment deterrents, and niche investment themes.

Historic Returns

The success of a REIT as an investment can be boiled down to its dividends and capital gains (collectively the “Total Return”). The chart below shows the current dividend yields of seven of the fifteen FIBRAs available for purchase on the Mexican stock exchange. When inflation (7.91%) and interest rates (10.5%) are considered, the true story emerges and the peso-denominated yields are put into context.

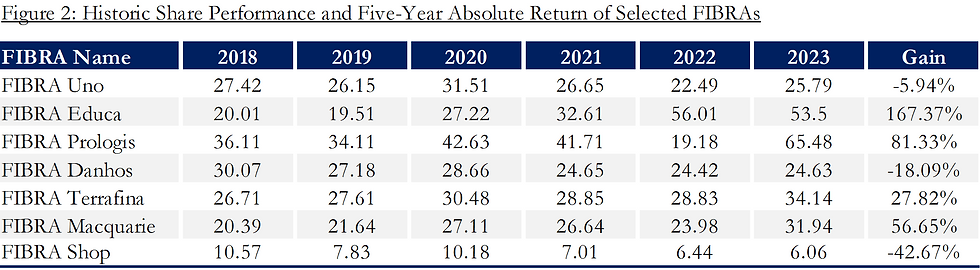

The chart below highlights the five-year market performance on the selected sample. While historic performance is not a guarantee of future results, it is a strong indicator. In the case of FIBRAs, past performance has been only somewhat interesting when viewed collectively. Individually, some have done quite well (e.g., FIBRA Educa, FIBRA Prologis) which indicates the share appreciation potential of the asset class.

Other Deterrents

The Total Return investment profile of FIBRAs is difficult to classify as “bad”, and some might even argue that they are attractive. That more capital hasn’t crossed the border is somewhat surprising, and suggests that other non-performance related factors are deterring investments. Some of those potential deterrents are considered below and they include: 1) agency issues in management structures, 2) taxation, and 3) currency concerns.

Agency issues are created by the structures employed in Mexico to manage the corresponding FIBRAs. The management teams are separate from, and not employed directly by, the FIBRA. The management companies are independent and often earn large fees and commissions for buying and selling properties, securing land, and other activities which arguably are not optimally aligned with maximizing shareholder value. Similar structures were once utilized in America but today virtually every REIT employs directly the managers and effectively aligns their compensation to shareholders’ interests. This misalignment of interests, even if a false perception, may be a reason more American capital hasn’t entered the fray. Changes in structures to reduce agency issues are unlikely until such time as FIBRA Uno, the clear market leader, takes action.

Taxation is somewhat complicated for American investors owning FIBRA shares. Capital gains on the sale of FIBRA shares aren’t taxed in Mexico, but they would be reported on the American tax return and subject to capital gains taxation. Most American investors would also be subject to a 30% withholding tax on dividends distributed. While double taxation treaties between the countries would mitigate this in most cases, an extra administrative step is introduced which wouldn’t be required if the investors had purchased similar investments in America.

Currency concerns are always a factor for American investors who invest into foreign-currency denominated assets. In the case of FIBRAs, this concern is mitigated by the fact that a large percentage of leases held are dollar-denominated. Additionally, the peso has been relatively stable over a five-year period and trades at essentially the same exchange rate today as it did then.

Niche Investment Themes

The core investment objective of any investment should be to realize the highest possible risk-adjusted return for investors. The investment decision is often shaped by other factors (i.e., liquidity, ESG/impact), and in the case of FIBRAs, certain American investors may appreciate the niche themes of: 1) satisfying asset allocation mandates, 2) hedging currency risk, and 3) as part of a market entry strategy.

Investment managers managing large pools of capital are governed by mandates which sometimes require portfolio diversification. The theory behind this is that although diversification sacrifices some upside, it works to preserve capital and reduce volatility in the portfolio. For such managers, FIBRAs provide an efficient way to fill emerging market, fixed income, and foreign real estate asset allocations. Asset preservation element are relevant as REITs contain real estate which will always possess some value. The competition for these investment dollars can be fierce and Mexico would need to edge out other interesting emerging market REITs such as those from Brazil, South Africa and India.

More exposure to the peso is something that a growing number of investors appreciate. Washington DC and the Federal Reserve Bank have worked together to dramatically increase the money supply and create conditions where dollar hegemony is not as certain today as it was just a few years ago. In an environment where the dollar is losing clout as the world’s currency, Mexico’s peso could fair well relative to other currencies. An American investor may also wish to hold peso-denominated assets as they can be used to offset peso-denominated liabilities (e.g., paying out pensions to pensioners, manufacturers taking loans in pesos).

Lastly, large American real estate investors and developers who wish to establish or grow their footprints in Mexico might benefit by doing so through the REIT structure. The best example of this is Prologis, an American based industrial property developer and operator with $196 billion of assets in 19 countries. In 2014, Prologis listed a FIBRA in Mexico called FIBRA Prologis which presently holds approximately $4.4 billion worth of assets across 44 million square feet of leasable area. By operating through the REIT structure, Prologis gains powerful taxation advantages, and is able to maintain control and generate significant fees as the appointed asset manager. Raising fresh capital to acquire new properties should be easier and cheaper if done through issuing more shares to the public. Its latest offering in late-2022 raised $410 million and at a dramatically lower costs (i.e., investors’ expected returns are lower) when compared to private equity and credit capital sources available in Mexico.